As a landlord, you want to make sure that your rental property is well-protected. One of the best ways to do this is by placing it into either an LLC or trust. But which one should you choose? The answer depends on your individual needs and goals as a landlord. Let’s explore the differences between these two legal tools and why you might want to consider using them for your rental property.

What is an LLC?

An LLC, or limited liability company, is a business structure that offers owners personal asset protection from any liabilities incurred by their business. It’s designed to provide entrepreneurs with limited liability protection while still allowing them to own and operate their business as if it were a sole proprietorship or partnership. If you are looking for more flexibility in your ownership structure and reduced levels of personal risk, then an LLC may be the right choice for your rental property.

What is a Trust?

A trust is a legal entity that can be used to hold assets such as real estate, cash, securities and other investments. Unlike an LLC, trusts have no members and offer complete anonymity when it comes to ownership of the asset(s). Additionally, trusts can provide tax advantages depending on how they are structured so they are often used by landlords looking for additional tax savings over what they would receive with traditional investments.

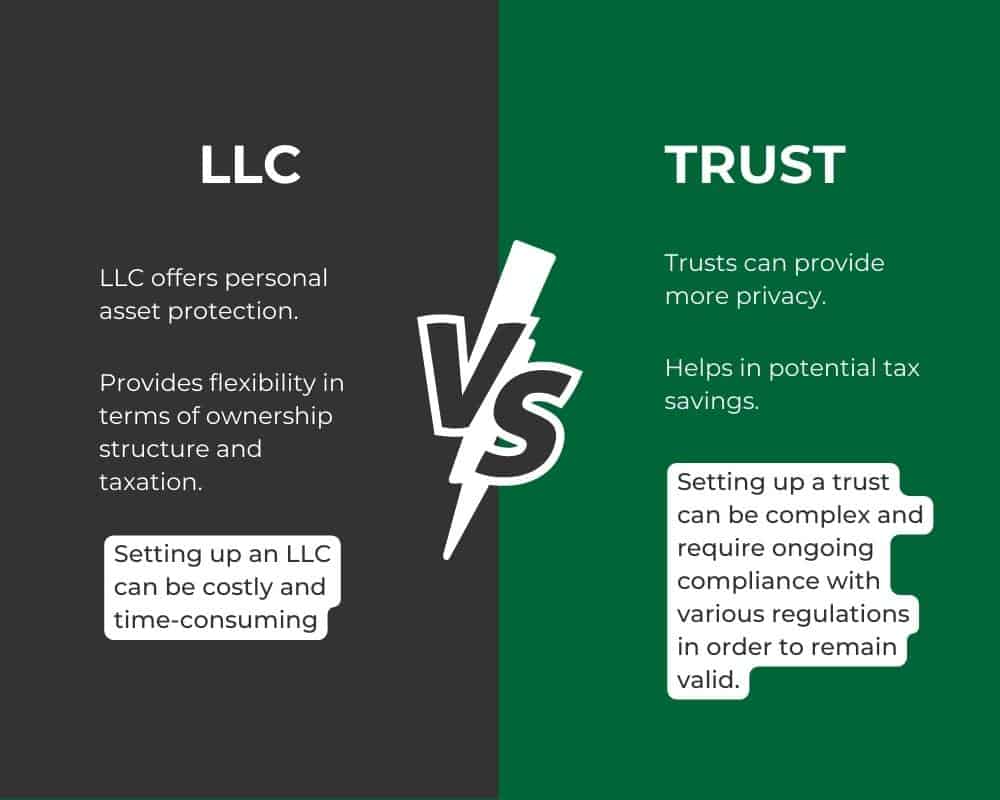

The Pros and Cons of Each Option

Both an LLC and trust offer several benefits when it comes to owning rental property, but each has its own set of pros and cons. An LLC offers personal asset protection from any liabilities that may arise from owning rental property while also providing flexibility in terms of ownership structure and taxation; however, setting up an LLC can be costly and time-consuming. On the other hand, trusts can provide more privacy when it comes to ownership of assets as well as potential tax savings; however, setting up a trust can be complex and require ongoing compliance with various regulations in order to remain valid.

When deciding whether or not to place your rental property into an LLC or trust, there are many factors to consider—including the costs associated with each option as well as the level of personal risk that you’re willing to take on. Ultimately, the decision will come down to what works best for you based on your individual needs and goals as a landlord. With the right advice from experienced professionals however, you can make sure that whatever path you decide on will help protect your investment now and in the future when you decide to sell…

Selling Rental Property Held Within a Trust or LLC

If you own a rental property that is held in a trust or LLC, it’s important to understand how trusts work and what steps are required when selling rental property within one. Generally speaking, there are just three simple steps no matter what legal entity owns the property:

– First, find an experienced real estate attorney who can provide legal advice and guidance throughout the process. The attorney will ensure that all necessary documents are filed correctly, as well as answer any questions you might have about selling rental property within a trust.

– Second, contact your local title company and request an estimate for closing costs associated with selling your rental property. This will give you an idea of how much money you’ll need upfront before closing on the sale.

– Third, list your property on multiple listing services (MLS) or hire a real estate agent who specializes in trusts and trusts sales to handle marketing and negotiations on behalf of your trust. This will ensure that potential buyers have access to your listing and that they’re aware of any special clauses or provisions associated with purchasing from within a trust.

When deciding whether or not to place your rental property into an LLC or trust, there are many factors to consider—including the costs associated with each option as well as the level of personal risk that you’re willing to take on. Ultimately, the decision will come down to what works best for you based on your individual needs and goals as a landlord.

Recent Comments