If you’re looking for a rental property to invest in, townhomes may be your best bet. Townhomes offer several advantages over single-family homes and apartments, but they also come with some drawbacks. Let’s take a closer look at the pros and cons of investing in townhomes as rental properties.

Pros of Investing in Townhomes as Rental Properties

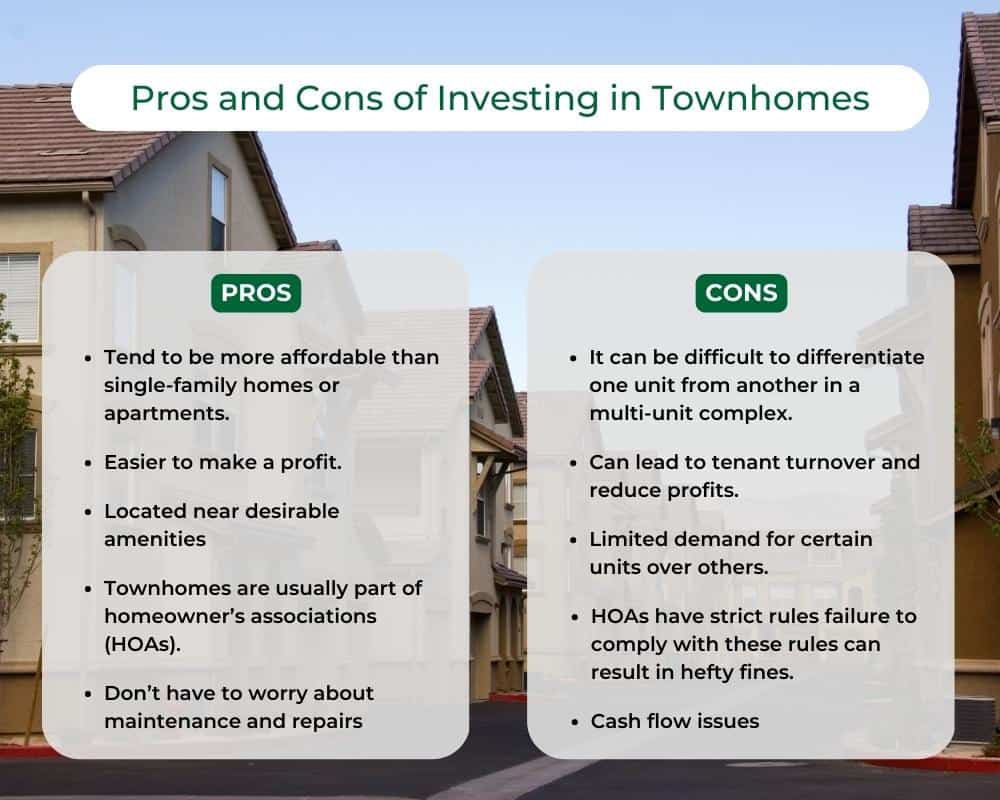

One of the major benefits of investing in townhomes is that they tend to be more affordable than single-family homes or apartments. Because of the low prices, this equals low financial risk for real estate investing. Townhomes fall within the median price range of local markets. This means that landlords can purchase them at lower prices, which makes it easier to make a profit on their investments. Additionally, townhomes are often located near desirable amenities such as shopping centers, parks, schools, and public transportation, making them an attractive option for renters looking for convenience. Finally, since townhomes are usually part of homeowner’s associations (HOAs), landlords don’t have to worry about maintenance and repairs—the responsibility lies with the HOA instead.

Furthermore, since townhomes are usually located close together and on small lots, landlords don’t have to worry about large landscaping projects or extensive lawn maintenance. This makes them relatively low-maintenance investments that don’t require a lot of time or money to keep up with. Lastly, townhouse rentals offer safety and security features that may not be available in other rental properties such as gated access and security systems.

Cons of Investing in Townhomes as Rental Properties

While there are definite advantages to investing in townhomes, there are also some drawbacks that landlords should consider before investing. One potential downside is that it can be difficult to differentiate one unit from another in a multi-unit complex—this can limit tenant turnover and reduce profits due to limited demand for certain units over others. Some potential downsides of investing in townhouses are a higher cost of entry, reduced potential for rentals, high HOA fees, and a slower appreciation rate. Additionally, most HOAs have strict rules regarding rentals that must be adhered to; failure to comply with these rules can result in hefty fines or even eviction proceedings against tenants. Finally, since many townhome complexes require tenants to pay utility bills directly rather than through their rent payment each month, tenants may not always pay on time which can lead to cash flow issues for landlords who depend on timely rent payments each month.

Choosing The Right Property For Your Goals

When it comes down to it, whether or not investing in townhomes is a good idea depends on the individual landlord’s needs and preferences. While there are definitely some great advantages associated with owning townhome rental properties—including affordability and high demand—there are also some potential downsides that should be carefully considered before making any investments. By weighing all the pros and cons carefully before making a decision you can ensure that you make an informed decision that works best for your specific situation as a landlord.

Recent Comments